Seriously and Literally

Seriously and Literally

- The Trump Administration came into office with policies that market participants perceived positively (lower taxes, deregulation) and negatively (tariffs, immigration).

- Fluctuating tariff policy has dominated the news cycle and created significant uncertainty.

- We are starting to see the impact of extreme policy uncertainty – particularly around trade – show up in economic data.

- Stock markets have declined, but only modestly. The sell-off has been most-significant in US large cap tech, companies that have the most to lose from tariffs, and in so-called Trump Trades like Bitcoin, Tesla, and DJT.

- Market volatility is slightly higher than it was at the start of the year, but it is not high from a historical perspective.

- We expect continued volatility and uncertainty through the balance of 2025.

- If April 2 brings some resolution to tariff uncertainty, we expect stocks to outperform bonds for the balance of the year.

“Leveling the playing field”

Last week, we attended the Economic Club of New York’s luncheon featuring President Trump’s Treasury Secretary Scott Bessent. Here is an excerpt, worth reading in our opinion, that captures the essence of his comments on trade (lightly edited for brevity and emphasis in bold is ours):

“The President has already begun a campaign to rebalance the international economic system. The international trading system consists of a web of relationships – military, economic, political… This is how President Trump sees the world… as inter-linkages that can be reordered to advance the interest of the American people.

This is contrary to the last several decades… the United States provided a source of massive demand, acted as arbiter of global peace, but did not receive adequate compensation. For example, today the United States finds itself subsidizing the rest of the world’s under-spending in defense.

This is not just a security issue. The United States also provides reserve assets, serves as a consumer of first and last resort, and absorbs excess supply in the face of insufficient demand in other country’s domestic models. This system is not sustainable.

This is what tariffs are designed to address – leveling the playing field such that the international trading system begins to reward ingenuity, security, rule of law, and stability, not wage suppression, currency manipulation, intellectual property theft, non-tariff barriers and draconian regulations. To the extent that another country’s practices harm our own economy and people the United States will respond. This is the America First Trade Policy.”

It was Anthony Scaramucci who first said we should take President Trump’s comments “Seriously, not literally.” It is our opinion that we should take Secretary Bessent’s comments seriously and literally.

We know that some clients are concerned about these policy proposals. Others are optimistic. We don’t take sides – our focus remains on impartial analysis, not adjudicating any administration’s policies. Whether or not the Trump administration is successful in these goals, the path to achieving the policies that Secretary Bessent laid out will disrupt the current economic order and create continued uncertainty and volatility in markets. Secretary Bessent has said as much over recent days – saying that the economy “may see some disruption,” may be starting to “roll a bit,” and that “there will be a detox period” – as they move toward their goals.

Historic policy uncertainty

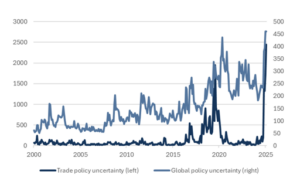

The Economic Policy Uncertainty Indexes developed by academics Scott R. Baker, Nicholas Bloom, and Steven J. Davis provide one way to visualize the policy shift taking place. Economic policy uncertainty has spiked (Fig. 1) globally, and particularly for trade policy.

Fig. 1: Economic policy uncertainty has spiked

Source: Bloomberg, Mill Creek.

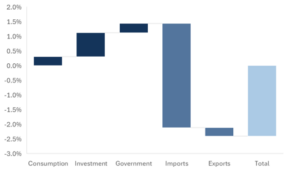

We can already see the uncertainty around trade policy making its way into our economic data. For example, US firms rushed to import goods ahead of tariff implementation, creating a wider-than-normal trade imbalance and pushing the Atlanta Fed’s Q1 GDP estimate into negative territory (Fig. 2). While this impact on Q1 GDP is likely to be reversed in the coming quarters, it shows how policy uncertainty can drive changes in real economic activity.

Fig. 2: Estimated components of Q1 2025 GDP growth (Atlanta Fed GDPNow)

Source: Bloomberg, Mill Creek.

Recent market reaction

US equity markets have declined recently, whereas international equities remain in positive territory year-to-date. As of last Friday, the MSCI All-Country World Index is up 1.5% year-to-date and -3.9% off its recent high. US Mega Cap Growth stocks have fallen -5.7% year-to-date and are -9.4% off their recent high. On the other hand, developed international markets are up 10.6% year-to-date and are within 0.5% of an all-time high.

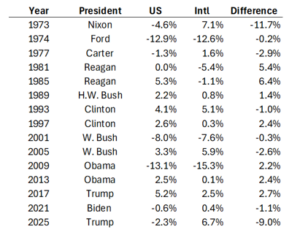

The gap between US and international equity market performance has been particularly acute. We have to go all the way back to President Nixon’s second inauguration to find a period where international stock outperformed by such a significant margin in the initial days of a presidency.

Fig. 3: US versus international performance during first 30 trading days post-inauguration

Source: Bloomberg, Mill Creek.

So-called “Trump trades” have also performed particularly poorly since inauguration day (Fig. 4).

Fig. 4: “Trump trades” have lost momentum

Source: Bloomberg, Mill Creek.

While stocks have experienced a sell-off, we don’t consider current market volatility or the extent of the decline to be exceptional. Historically, equity investors have experienced a 10% drawdown nearly every year and 10-20% declines every 3 years or so.

We are not, at the current time, making changes to our target portfolio positioning. We continue to encourage investors to hold well-diversified equity portfolios and rebalance if necessary. For reference, our target exposure to international equities is 34% of an equity portfolio. We recognize that taxes and other considerations can prevent investors from matching our suggested target allocation.

We also continue to strongly recommend diversifying out of public stocks and bonds and into alternative income strategies (e.g., private credit, farmland, and stabilized multifamily real estate) and private equity. Our investment committee also recently approved a value-add real estate strategy that we anticipate will be ready for commitments at the beginning of the second quarter.

We know that many of you are concerned about the current market environment. If you have any comments or questions or would like to have a conversation about the markets, please don’t hesitate to reach out to your advisor or contact me directly.

Michael Crook, CAIA

Chief Investment Officer

mcrook@millcreek.com

Disclosures & Important Information

Any views expressed above represent the opinions of Mill Creek Capital Advisers ("MCCA") and are not intended as a forecast or guarantee of future results. This information is for educational purposes only. It is not intended to provide, and should not be relied upon for, particular investment advice. This publication has been prepared by MCCA. The publication is provided for information purposes only. The information contained in this publication has been obtained from sources that

MCCA believes to be reliable, but MCCA does not represent or warrant that it is accurate or complete. The views in this publication are those of MCCA and are subject to change, and MCCA has no obligation to update its opinions or the information in this publication. While MCCA has obtained information believed to be reliable, MCCA, nor any of their respective officers, partners, or employees accepts any liability whatsoever for any direct or consequential loss arising from any use of this publication or its contents.

© 2025 All rights reserved. Trademarks “Mill Creek,” “Mill Creek Capital” and “Mill Creek Capital Advisors” are the exclusive property of Mill Creek Capital Advisors, LLC, are registered in the U.S. Patent and Trademark Office, and may not be used without written permission.